The Europe 3D printing medical devices market is expected to reach US$ 1,986.9 million by 2028 from US$ 642.6 million in 2021. The market is estimated to grow at a CAGR of 17.5% from 2021–2028.

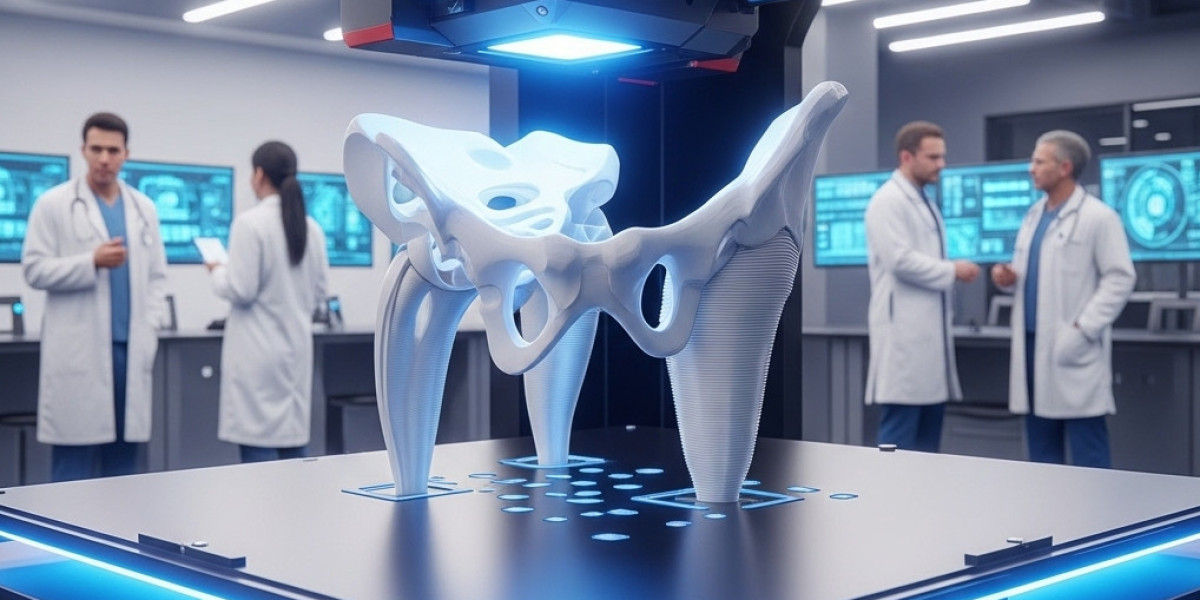

3D printing is increasingly being used in the production of a wide range of medical devices, particularly those with complex structures or features tailored to an individual patient’s anatomy. While some devices are produced using standard designs and replicated in large quantities, others—known as patient-matched or patient-specific devices—are created using imaging data unique to each patient. The selection of 3D printing technology depends on factors such as the device's intended use and the complexity of the printer. Among the various technologies, powder bed fusion is the most widely used for manufacturing medical devices due to its compatibility with materials like titanium and nylon.

One of the key advantages of 3D printing in the medical field is the ability to produce accurate, patient-specific models from CT and MRI scans quickly and cost-effectively. These tactile reference models provide surgeons with valuable insights, enhancing preoperative planning, reducing time spent in the operating room, cutting costs, and ultimately improving surgical outcomes. Patients also benefit from shorter recovery periods, reduced anxiety, and greater overall satisfaction. Additionally, the development of new biocompatible 3D printing materials is facilitating the creation of innovative surgical tools and techniques. These include sterilizable fixation trays, contouring templates, and implant sizing models that help surgeons optimize implant selection before making the first incision, improving precision during complex procedures.

In response to the COVID-19 pandemic, the European Commission delayed the transition from the Medical Devices Directive (MDD) to the Medical Device Regulation (MDR), allowing manufacturers and Notified Bodies to focus resources on addressing the health crisis. However, no similar delay was announced for the In Vitro Diagnostic Regulation (IVDR) 2017/246, which remained scheduled for implementation in May 2021. This has increased pressure on IVD manufacturers, who must continue preparing for regulatory changes while meeting surging demand for diagnostic tests and managing challenges in kit production and distribution. Furthermore, the European Commission temporarily required export authorization for certain medical devices such as personal protective equipment (PPE), complicating supply commitments for manufacturers serving markets outside the EU. Notably, Norway, Liechtenstein, and Switzerland are exempt from these export restrictions.

As vendors introduce advanced technologies and features, they are well-positioned to attract new customers and expand into emerging markets. These developments are expected to contribute to a strong compound annual growth rate (CAGR) in the European 3D printing medical devices market over the forecast period.

Europe 3D Printing Medical Devices Market Segmentation

Europe 3D printing medical devices market By Component

- Software and Services

- Equipment

- 3D Printers

- 3D Bioprinters

- Materials

- Plastics Material

- Metal and Metal Alloys

- Bioprinting Biomaterials

- Wax

- Others

Europe 3D printing medical devices market By Technology

- Laser Beam Melting

- Direct Metal Laser Sintering

- Selective Laser Sintering

- Selective Laser Melting

- LaserCusing

- Photopolymerization

- Stereolithography

- Others

- Droplet Deposition/Extrusion Based Technologies

- Fused Deposition Modelling

- Multiphase Solidification

- Low Temperature Deposition Manufacturing

- Electron Beam melting

Europe 3D printing medical devices market By Application

- Custom Prosthetics and Implants

- Craniomaxillofacial Implants

- Custom Dental Prosthetics and Implants

- Custom Orthopaedic Implants

- Surgical Guides

- Dental Guides

- Orthopaedic Guides

- Craniomaxillofacial Guides

- Spinal Guides

- Tissue Engineering Products

- Bone and Cartilage Scaffolds

- Ligaments and Tendons Scaffolds

- Surgical Instruments

- Surgical Fasteners

- Scalpels

- Retractors

- Hearing Aids

- Wearable Medical Devices

- Standard Prosthetic and Implants

- Others

Europe 3D printing medical devices market By End-User

- Hospitals and Surgical Centres

- Dental and Orthopaedic Centres

- Medical Device Companies

- Pharmaceutical and Biotechnology Companies

- Academic and Research Institutes

- Others

Europe 3D printing medical devices market By Country

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

Europe 3D printing medical devices market Companies Mentioned

- EOS GmbH Electro Optical Systems

- Renishaw PLC

- Stratasys Ltd.

- 3D Systems, Inc.

- EnvisionTech, Inc.

- Concept Laser Gmbh (General Electric)

- Proadways Group

- SLM Solution Group AG

- CELLINK

- 3T RPD Ltd

Europe 3D printing medical devices market Strategic Insights

Strategic insights for the Europe 3D printing medical devices market provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

Europe 3D printing medical devices market Regional Insights

The geographic scope of the Europe 3D printing medical devices market refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

About Us:

Business Market Insights is a market research platform that provides subscription service for industry and company reports. Our research team has extensive professional expertise in domains such as Electronics & Semiconductor; Aerospace & Defense; Automotive & Transportation; Energy & Power; Healthcare; Manufacturing & Construction; Food & Beverages; Chemicals & Materials; and Technology, Media, & Telecommunications.

Author’s Bio:

Suryakant Gadekar

Senior Market Research Expert at Business Market Insights